The rise in e-way bill could be driven by improved compliance as more businesses are opting to report transactions formally.

| Photo Credit:

Kesavan A N@Chennai

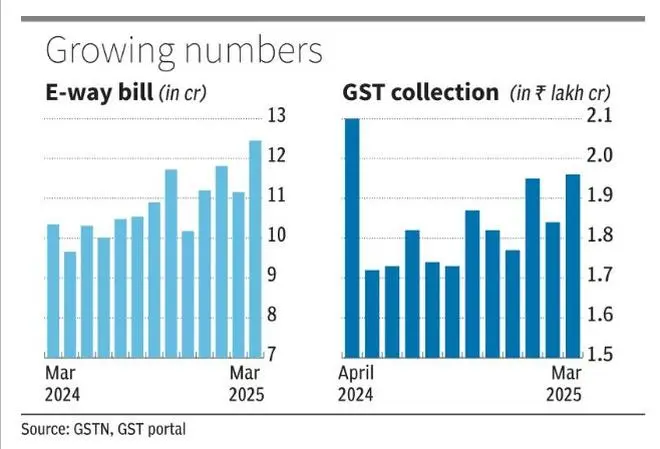

Indicating very high year-end business activities, e-way bill (EWB) generation surged 20 per cent high in March to reach ₹12 crore plus for the first time since its introduction in 2018. Experts express cautious optimism about impact of all-time high e-way bill generation.

Data pertaining to GST collection in April will be made public on May 1. Since the introduction of GST in 2017, April collections always set a new record. While collections crossed ₹1 lakh crore for the first time in April 2018, it set a new high of ₹1.13 lakh crore in April 2019. The Covid-19 pandemic affected collections in April 2020, but in April 2021, it went to a record ₹1.41 lakh crore. April 2022 saw a collection of ₹1.68 lakh crore followed by new all time high of ₹1.87 lakh crore and ₹2.10 lakh crore in April 2023 and April 2024, respectively.

An e-way bill is an electronic document generated on a portal, evidencing the movement of goods. It also indicates whether tax has been paid for the moving goods. As per Rule 138 of the CGST Rules, 2017, every registered person involved in the movement of goods (which may not necessarily be on account of supply) of consignment value of more than ₹50,000 (can be lower for intra-state movement) is required to generate an e-way bill.

Growth drivers

Explaining the reasons behind record EWB in March, Amit Baid, Head of tax at BTG Advaya, said it could be driven by improved compliance as more businesses are opting to report transactions formally. Also, with March being the financial year-end, it often sees a natural spike as companies rush to close books and clear inventories even when actual production or consumption hasn’t risen at the same pace. “Better compliance and reporting are important wins in themselves and lay the foundation for more sustainable revenue growth,” he said.

Sudipta Bhattacharjee, Partner at Khaitan & Co, said 20 per cent plus rise in EWB generation reflects heightened economic activity on account of March 31 being the financial year-end, prompting businesses to clear inventories and push harder to meet financial year targets. Improved enforcement against GST frauds leading to enhanced overall compliance levels would have played a role too. “This should have a positive correlation with improved GST collections for March 2025 – to be reported in April,” he said.

Key indicator

According to MS Mani, Partner at Deloitte, e-way bill generation is a good precursor to the expected GST collections during a month and higher e-way bill generation would normally mean increased GST collections. “A linear relationship between the percentage increase in the number of e-way bills generated and the GST collections would not be possible as GST is based on the value of the invoices and is also impacted by services, which do not require an e-way bill,” he said.

Baid said higher e-way bills generally signal better GST numbers, but the real test is sustainability. “If consumer spending remains tepid amid global uncertainty, this uptick may be short-lived or concentrated in a few sectors,” he concluded.

More Like This

Published on April 14, 2025