Successful of hand trader trading stock exchange graph money, global economic, trader investor,graph money of block chain stock market cryptocurrency selling and buy with price chart data graph istock photo for BL

| Photo Credit:

Thitima Uthaiburom

The week before last, US 10-year bonds witnessed the worst week since 2001, with yields spiking 50 basis points over the week to 4.5 per cent. Though yields cooled over the week gone by, a new drama surfaced with a brewing feud between President Trump and Fed Chair Powell.

While the Trump administration is determined to bring yields on long-term bonds down, the Fed’s preference to wait and watch given tariff-led upside risks to inflation is playing a brick wall. Last week, Trump said he couldn’t wait to have Powell’s office terminated, while at the same time Powell’s chairmanship is legally well-guarded. The deadlock is a classic case of when an unstoppable force meets an immovable object.

The ‘elephant in the room’ here is the US government’s massive debt pile of $36.2 trillion. The country has been on a spending spree since the global financial crisis, which accelerated when the Covid pandemic hit.

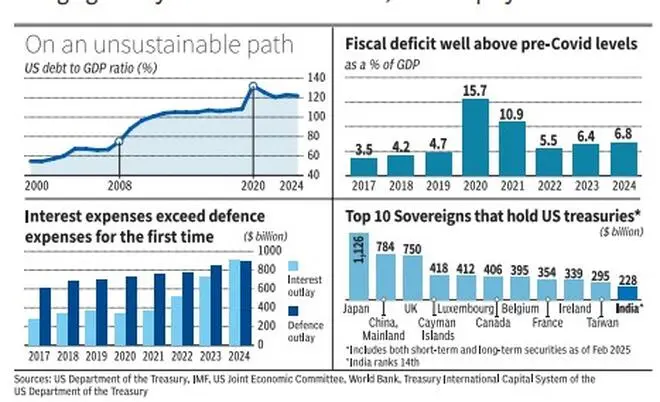

Today, the US’ debt to GDP stands at a significant 122 per cent (December 2024). Bond yields shooting up can burn a hole through the Federal Government’s finances, thus explaining Trump and his administration’s fixation on bond yields. In fact, it was the bond tantrum from the earlier week that pushed Trump to swiftly go slow on reciprocal tariffs.

Three factors

The debt-related problems for Trump administration stem from three factors.

First is the refinancing problem. The previous administration ducked the interest rate pressure by issuing short-term bills instead of long-term bonds. While the approach was unsustainable for long, it’s the current administration’s problem to now refinance them with long-term bonds and will add further pressure on yields.

Two, is the issue of the US government’s addiction to spending, which of course Trump is trying to address with DOGE. While the US fiscal deficit cooled to 5.5 per cent of GDP in 2022 (calendar year) after having skyrocketed to 15.7 per cent of GDP in 2020 due to Covid stimulus, the ratio has now inched back to 6.8 per cent. Even worse, interest outlay of the Federal Government for 2024 surpassed the national defence outlay for the first time in the nation’s history. This reminds of Ferguson’s law – ‘any great power that spends more on debt servicing than on defence, risks ceasing to be a great power’.

The third factor is one that is self-inflicted. The policy of the Trump administration, going back and forth, attempts to upend global supply chains and could tarnish the safe-haven status of US Treasury securities and the global reserve currency status of the dollar. This is where trade war blows up into capital wars. Although there is no strong alternative to the US dollar yet, global central banks might turn to other currencies or gold even more. A week ago, speculations were rife in the bond market that China could retaliate by dumping its holdings of US bonds. This was one of the key reasons for the yield to go up the week before last, although the exact reason for the tantrum is still being investigated.

US debt, an equity woe

Decades earlier, Richard Nixon’s Treasury Secretary famously said: “the dollar is our currency, but it’s your problem”.

Similarly, this debt pile of the US and high yields are not only a problem for the US, but one for equity investors across the globe. First, the policies that the Trump administration is trying to implement could result in a stagflation in the US, a period of recession driven by inflated prices.

Top investment bankers have forecast a 50 per cent/60 per cent probability of a recession. In a globalised economic environment, this means a slowdown in global GDP. This combined with high US bond yields, used as benchmark to price risk assets across the globe, can be a double whammy for equity investors.

Investors across the world, including in India, must keep an eye on the US bond market.

Published on April 19, 2025