Global demand for smart watches is climbing fast, but a quiet quarter for the Apple Watch let Xiaomi reclaim the top spot.

The global wearable band market grew 13% year over year in the first quarter of 2025, reaching 46.6 million shipments, according to new data from Canalys. The rebound was driven by broad demand across categories, especially in emerging markets, and a low comparison base from the first quarter of 2024.

Xiaomi surged back into the lead with 8.7 million units shipped, up 44% from 2024. The company credited strong Redmi Band 5 sales and deeper integration through HyperOS, its custom operating system.

A newly self-developed smartphone chip and a tightly coordinated product portfolio helped Xiaomi improve its value proposition, particularly in price-sensitive regions.

Apple, Huawei & Samsung expand ecosystems

Apple came in second with 7.6 million Apple Watch shipments, a modest 5% increase from 2024. That’s in line with seasonal expectations, as the first quarter tends to be the furthest point from Apple’s typical September refresh cycle.

Instead of chasing hardware overhauls, Apple is focusing on enhancing the stickiness of its ecosystem.

Its health and fitness integrations, privacy protections, and seamless iPhone pairing continue to set the Watch apart in premium segments. But with its install base largely saturated, sustained growth will likely come from services like Fitness+ and health monitoring features.

Huawei held third place with 7.1 million units shipped, a 36% year-over-year gain. Its GT and Fit series found traction outside China, supported by a wider rollout of the Huawei Health app. Samsung followed with 4.9 million shipments, a sharp 74% increase driven by a dual-market strategy.

Garmin rounded out the top five with 1.8 million units shipped, up 10%. The launch of Garmin Connect+, a subscription platform for deeper health insights and training tools, signals the brand’s move toward recurring revenue.

Ecosystems take center stage

As hardware margins tighten, vendors are shifting focus from features to ecosystems. Companies are accelerating service development to boost retention and long-term value.

That shift is especially visible in China, where Xiaomi is using HyperOS to link phones, wearables, and smart home products into a unified experience. Huawei is taking a more health-centric approach, building a closed-loop system through its Health app.

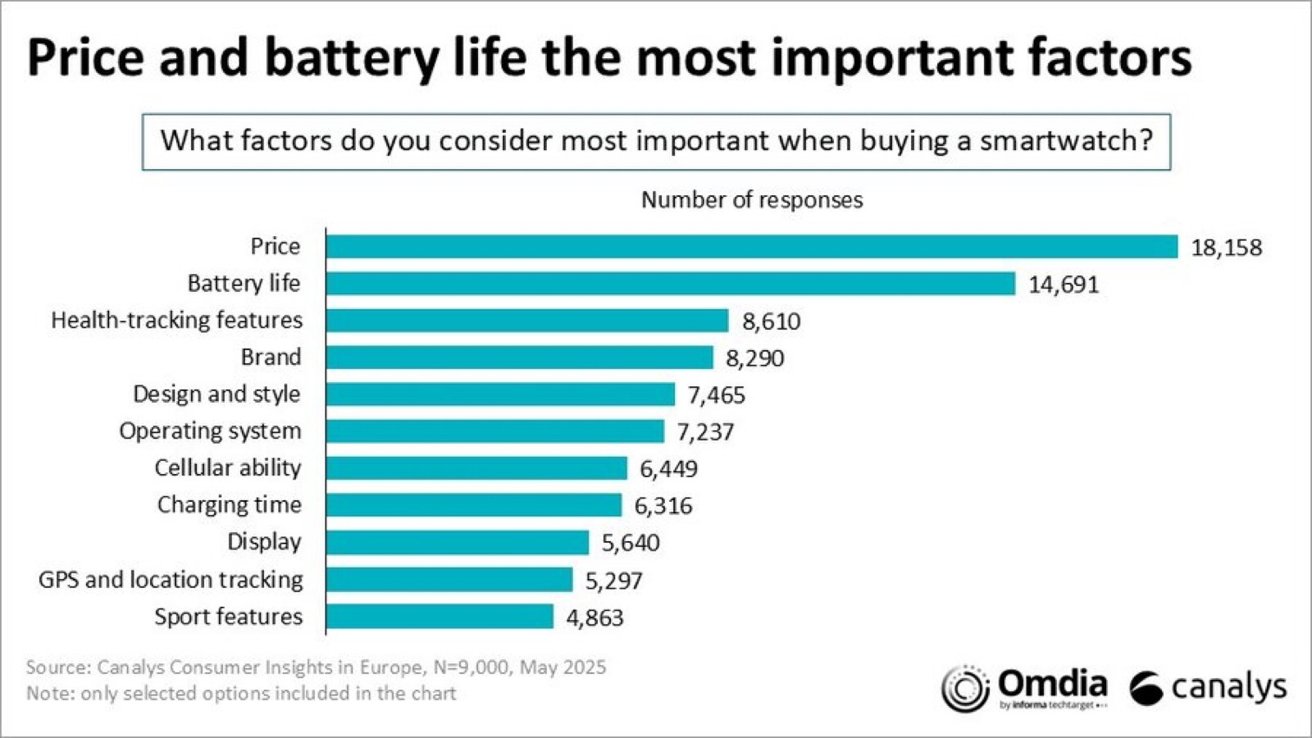

Important factors for consumers. Image credit: Canalys

Globally, brands like Oura and Whoop have leaned into subscription models from the start, positioning wearables as continuous services rather than one-time purchases.

Price, battery life, and health tracking remain the top buying factors. But as ecosystems mature and software capabilities expand, vendors that offer reliable integration and trusted data handling will have the edge.

Xiaomi’s rise highlights how affordable devices, when paired with a growing ecosystem, can take the lead even against brands with a head start. Meanwhile, Apple’s challenge is no longer selling the Apple Watch but making it indispensable.

Success will depend less on how many features a device boasts, and more on how well those features are connected, supported, and monetized across the broader platform.