The government on March 25 had told Parliament that farmers (19.79 applications) have received claims of ₹1,73,938 crore under PMFBY

| Photo Credit:

SRINATH M

Profits of companies from crop insurance business have increased in the last three years compared to previous three years. This is mainly due to favourable monsoon as also infusion of technology. This has resulted in some companies returning to crop insurance business after quitting it earlier.

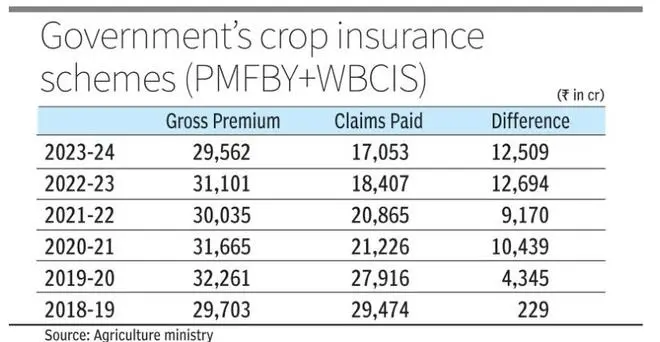

Latest official data show that companies gained by ₹34,373 crore between 2021-22 and 2023-24 as they had paid a total claim of ₹56,325 crore while collected ₹ 90,698 crore as premium in the government crop insurance schemes. The farmers’ contribution in the gross premium was ₹10,937 crore in the last three years.

In contrast, the insurers had paid a total claim of ₹78,616 crore after collecting ₹93,629 crore as gross premium between 2018-19 and 2020-21, only about ₹15,013 crore of profit, which is about ₹2,000 crore higher than the farmers’ share of premium.

“It is not that every insurance company is making a big profit. It depends on its spread of business over the geographies and the crops selected as there are some major risk-prone areas where the claim amount is usually on the higher side. Companies need to offset those risks by taking up insurance in relatively safer areas as well,” an official source said.

In 2023-24, Chola MS while returning to crop insurance business after two years had to disburse claim amount of ₹406 crore while collecting ₹526 crore of premium. Oriental Insurance, which had also stayed away for two years, had paid about ₹3,360 crore in 2023-24, making a loss as its gross premium collection was about ₹1,912 crore.

Agriculture Insurance Company of India (AIC), which has the largest presence in the flagship PMFBY scheme, had paid claims worth ₹5,565 crore whereas its gross premium collection was nearly ₹9,490 crore in 2023-24, official data show.

Cup & cap model

Official sources said from Kharif 2023, the government has allowed cup and cap model (80:110 and 60:130) in which profit and loss of insurers is shared. In case of claims below a certain threshold, portion of the premium paid by the government (both the Centre and the States) as subsidy goes back to the State treasury. In case of claims above a certain threshold, the Centre and the States are required to pay claims.

The government on March 25 had told Parliament that farmers (19.79 crore applications) have received claims of ₹1,73,938 crore under PMFBY, as against paying a premium of ₹32,476 crore until 2023-24 (as on February 28) since the inception of the scheme in 2016-17. The claims are yet to be finalised for 2024-25.

Higher claim ratio

Crop damages in Maharashtra, Andhra Pradesh, Haryana and Chhattisgarh in 2018-19 had pushed farmers’ claims against the premium collected by the insurance companies to over 100 per cent, whereas the claim ratio (against gross premium) was 75.4 per cent on all-India basis.

Under PMFBY and Weather Based Crop Insurance Scheme, farmers pay fixed 1.5 per cent of sum insured for rabi crops and 2 per cent for kharif while it is 5 per cent for cash crops. The actual premium is derived through a process of bids from insurers every year and any amount above what farmers pay is subsidised by the government which is shared between Centre and States on 50:50 basis.

More Like This

Published on April 6, 2025